How is the property market doing this year versus forecasts?

The headline news is that the property market is doing well and has once again proved many forecasters wrong, with house prices in particular performing slightly better than was predicted last year.

Average house prices 2024

The latest data from Hometrack shows that the average UK house price has risen by 1.4% this year so far (in the 7 months to July), and looks on track to reach +2.5% by the end of 2024. This is one of the most reliable and up-to-date indices, as it tracks both mortgaged and cash sales, and doesn’t have the same time ‘lag’ as Land Registry data. In terms of year-on-year performance, their annual growth figure up to the end of July is only +0.5%, but that’s because average house prices fell in the second half of 2023.

On the other hand, Nationwide, which tracks purchases with a mortgage, reports an annual growth rate of 2.4% in August – the highest in almost two years, up from 2.1% in July.

What were the forecasts for 2024?

In October 2023, JLL, one of the most prominent market forecasters, predicted we would see price falls continue into early 2024 and that average house values would be down by 3% over the year.

Similarly, in December, the CBRE didn’t expect inflation to reach its 2% target until early 2025 and predicted that mortgage financing would remain a drag on the economy until the second half of 2024. They forecast “a marginal fall in house prices and transaction volumes to be broadly level to 2023.”

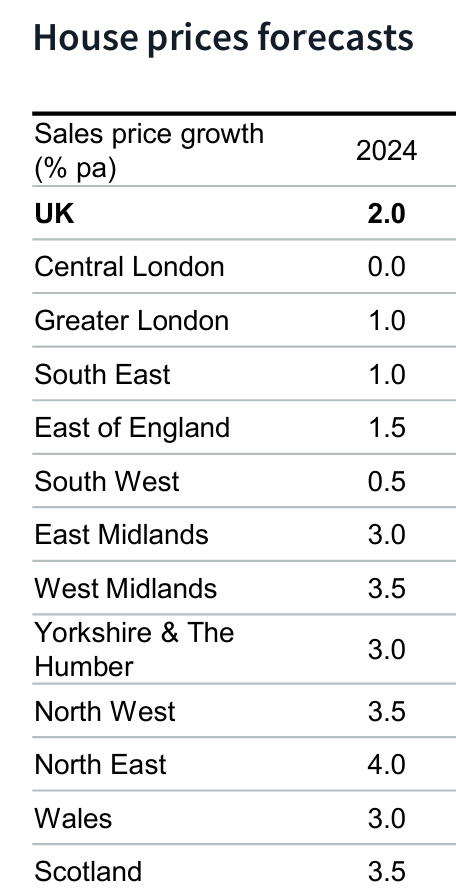

However, as the market began to show good signs of improvement, by May this year most forecasters had started to predict rises of 2%-4% in 2024 for most regions – which currently looks to be about right. JLL is forecasting a clear divide between London and the South of England, where increases will be minimal, and the Midlands, North of England, Wales and Scotland, where they expect price rises of between 3% and 4%:

Why has the sales market performed better than expected?

Given the way a record inflation level and 15-year base rate high impacted the cost of living, consumer confidence and mortgage interest rates, the property market unsurprisingly suffered slightly over the 18 months or so to the end of 2023.

But markets don’t tend to remain stagnant for long, and it was clear by the start of this year that people were keen to get moving again. This was encouraged by lenders gradually beginning to lower rates in anticipation of a late summer Bank of England base rate reduction, driven by the fact that inflation came back under control more quickly than expected.

So, we were seeing much more attractive mortgage deals in the first half of 2024, well before the base rate eventually came down to 5% in August. This, combined with increasing consumer confidence and the fundamental requirement for home moving, has resulted in the stable, rising market we’re currently seeing.

What was expected to happen to rents in 2024?

With a continuing shortage of stock and strong demand, it was widely expected that rents would keep being pushed further upward in 2024. In the spring, JLL predicted an average rise of 4.5% for the year.

How have rents performed so far this year?

While rental demand is still outstripping supply in the vast majority of areas, the gap does appear to be closing slightly. Rightmove reported in May that rental stock had increased by 8% annually, although it’s still below pre-pandemic levels.

And that means rents are continuing to increase – and can do so, thanks to wage growth also being higher than expected. In some places, rents are rising at double-digit rates, with the ONS reporting rent growth in the 12 months to July of:

- England 6%

- Wales 9%

- Scotland 2%

While these increases might be a little lower than we’ve seen in recent years, they’re still significantly higher than the forecasts. And with average wage growth running at around double the rate of inflation, working tenants can afford to keep competing prices upwards.

As always, activity and prices in one area can be vastly different to the next, so if you’d like a detailed insight into local house prices or rents, contact your nearest branch and one of the team will be very happy to help.

Looking for advice?

If you're looking to let or sell your property, we can help. Get in touch with your local branch or book in for a property valuation.

Contact Us

Got a question, general enquiry or something else?

You may also like

Since we started in 1987 we have grown to one of the UK’s largest property groups, we can save you time and money by offering a range of services and expertise under one roof.